IATA

-

IATA release – COVID-19 coloca em risco mais da metade das receitas de passageiros em 2020

COVID-19 Puts Over Half of 2020 Passenger Revenues at Risk

14 April 2020 (Geneva) – The International Air Transport Association (IATA) released updated analysis showing that the COVID-19 crisis will see airline passenger revenues drop by $314 billion in 2020, a 55% decline compared to 2019.

On 24 March IATA estimated $252 billion in lost revenues (-44% vs. 2019) in a scenario with severe travel restrictions lasting three months.

The updated figures reflect a significant deepening of the crisis since then, and reflect the following parameters:

- Severe domestic restrictions lasting three months

- Some restrictions on international travel extending beyond the initial three months

- Worldwide severe impact, including Africa and Latin America (which had a small presence of the disease and were expected to be less impacted in the March analysis).

Full-year passenger demand (domestic and international) is expected to be down 48% compared to 2019.The two main elements driving this are:

Overall Economic Developments: The world is heading for recession. The economic shock of the COVID-19 crisis is expected to be at its most severe in Q2 when GDP is expected to shrink by 6% (by comparison, GDP shrank by 2% at the height of the Global Financial Crisis). Passenger demand closely follows GDP progression. The impact of reduced economic activity in Q2 alone would result in an 8% fall in passenger demand in the third quarter.

Travel Restrictions: Travel restrictions will deepen the impact of recession on demand for travel. The most severe impact is expected to be in Q2. As of early April, the number of flights globally was down 80% compared to 2019 in large part owing to severe travel restrictions imposed by governments to fight the spread of the virus. Domestic markets could still see the start of an upturn in demand beginning in the third quarter in a first stage of lifting travel restrictions. International markets, however, will be slower to resume as it appears likely that governments will retain these travel restrictions longer.

“The industry’s outlook grows darker by the day. The scale of the crisis makes a sharp V-shaped recovery unlikely. Realistically, it will be a U-shaped recovery with domestic travel coming back faster than the international market. We could see more than half of passenger revenues disappear. That would be a $314 billion hit. Several governments have stepped up with new or expanded financial relief measures but the situation remains critical. Airlines could burn through $61 billion of cash reserves in the second quarter alone. That puts at risk 25 million jobs dependent on aviation. And without urgent relief, many airlines will not survive to lead the economic recovery,” said Alexandre de Juniac, IATA’s Director General and CEO.

Financial Relief

Governments must include aviation in stabilization packages. Airlines are at the core of a value chain that supports some 65.5 million jobs worldwide. Each of the 2.7 million airline jobs supports 24 more jobs in the economy.

“Financial relief for airlines today should be a critical policy measure for governments. Supporting airlines will keep vital supply chains working through the crisis. Every airline job saved will keep 24 more people employed. And it will give airlines a fighting chance of being viable businesses that are ready to lead the recovery by connecting economies when the pandemic is contained. If airlines are not ready, the economic pain of COVID-19 will be unnecessarily prolonged,” said de Juniac.

IATA proposes a number of relief options for governments to consider, including:

- Direct financial support to passenger and cargo carriers to compensate for reduced revenues and liquidity attributable to travel restrictions imposed as a result of COVID-19;

- Loans, loan guarantees and support for the corporate bond market by governments or central banks. The corporate bond market is a vital source of finance for airlines, but the eligibility of corporate bonds for central bank support needs to be extended and guaranteed by governments to provide access for a wider range of companies.

- Tax relief: Rebates on payroll taxes paid to date in 2020 and/or an extension of payment terms for the rest of 2020, along with a temporary waiver of ticket taxes and other government-imposed levies.

Read remarks of Alexandre de Juniac

View the COVID-19 Updated Impact AssessmentENDS

For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.orgNotes for editors:

- IATA (International Air Transport Association) represents some 290 airlines comprising 82% of global air traffic.

- You can follow us at https://twitter.com/iata for announcements, policy positions, and other useful industry information.

-

Invitación: IATA | Press Conferece Global mar 14 de abr de 2020 09:00 – 10:00 (BRT)

Prezados jornalistas,

Gostaríamos de convidá-lo para a atualização semanal da IATA sobre o impacto da crise da COVID-19 na indústria mundial da aviação. Após as apresentações do diretor-geral e CEO, Alexandre de Juniac, e do economista-chefe da IATA, Brian Pearce, haverá uma sessão de perguntas e respostas.

Data: Terça-feira, 14 de abril de 2020

Horário: 9h (horário de Brasília)

Acesse a teleconferência por meio deste link ou pelo número de telefone local que você encontra aqui.

O ID da conferência é 200 544 725#

Caso tenha dúvidas, por favor, entre em contato.

-

IATA release – Demanda de passageiros em fevereiro

Passenger Demand Plunges on COVID-19 Travel

Restrictions

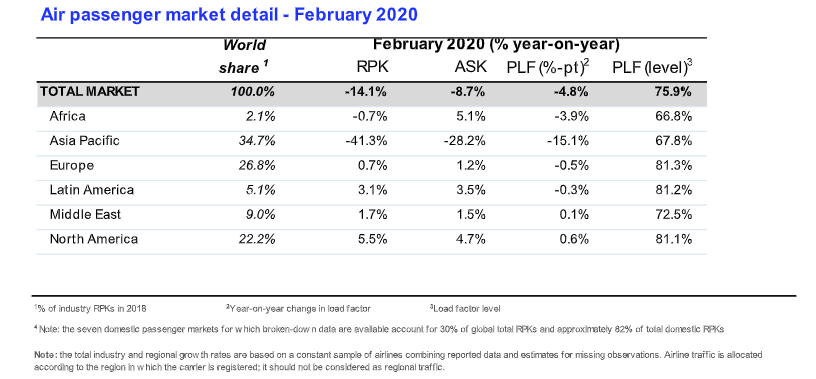

2 April 2020 (Geneva) – The International Air Transport Association (IATA) announced global

passenger traffic data for February 2020 showing that demand (measured in total revenue

passenger kilometers or RPKs) fell 14.1% compared to February 2019. This was the steepest

decline in traffic since 9.11 and reflected collapsing domestic travel in China and sharply falling

international demand to/from and within the Asia-Pacific region, owing to the spreading COVID-

19 virus and government-imposed travel restrictions. February capacity (available seat

kilometers or ASKs) fell 8.7% as airlines scrambled to trim capacity in line with plunging traffic,

and load factor fell 4.8 percentage points to 75.9%.

“Airlines were hit by a sledgehammer called COVID-19 in February. Borders were closed in an

effort to stop the spread of the virus. And the impact on aviation has left airlines with little to do

except cut costs and take emergency measures in an attempt to survive in these extraordinary

circumstances. The 14.1% global fall in demand is severe, but for carriers in Asia-Pacific the

drop was 41%. And it has only grown worse. Without a doubt this is the biggest crisis that the

industry has ever faced,” said Alexandre de Juniac, IATA’s Director General and CEO.

International Passenger Markets

February international passenger demand fell 10.1% compared to February 2019, the worst

outcome since the 2003 SARS outbreak and a reversal from the 2.6% traffic increase recorded

in January. Europe and Middle East were the only regions to see a year-over-year traffic rise.

Capacity fell 5.0%, and load factor plunged 4.2 percentage points to 75.3%.

Asia-Pacific airlines’ February traffic plummeted 30.4% compared to the year-ago

period, steeply reversing a 3.0% gain recorded in January. Capacity fell 16.9% and load

factor collapsed to 67.9%, a 13.2-percentage point drop compared to February 2019.

European carriers’ February demand was virtually flat compared to a year ago (+0.2%),

the region’s weakest performance in a decade. The slowdown was driven by routes

to/from Asia, where the growth rate slowed by 25 percentage points in February, versus

January. Demand in markets within Europe performed solidly despite some initial flight

suspensions on the routes to/from Italy. However, March data will reflect the impact of

the spread of the virus across Europe and the related disruptions to travel. February

capacity rose 0.7%, and load factor slipped 0.4 percentage point to 82.0%, which was

the highest among regions.

Middle Eastern airlines posted a 1.6% traffic increase in February, a slowdown from

the 5.3% year-over-year growth reported in January largely owing to a slowdown onMiddle East-Asia-Pacific routes. Capacity increased by 1.3%, and load factor edged up

0.2 percentage point to 72.6%.

North American carriers had a 2.8% traffic decline in February, reversing a 2.9% gain

in January, as international entry restrictions hit home and volumes on Asia-North

America routes plunged 30%. Capacity fell 1.5%, and load factor dropped 1.0

percentage point to 77.7%.

Latin American airlines experienced a 0.4% demand drop in February compared to the

same month last year. This actually was an improvement over the 3.5% decline

recorded in January. However, the spread of the virus and resulting travel restrictions

will be reflected in March results. Capacity also fell 0.4% and load factor was flat

compared to February 2019 at 81.3%.

African airlines’ traffic slipped 1.1% in February, versus a 5.6% traffic increase

recorded in January and the weakest outcome since 2015. The decline was driven by

around a 35% year-on-year traffic fall in the Africa-Asia market. Capacity rose 4.8%,

however, and load factor sagged 3.9 percentage points to 65.7%, lowest among regions.

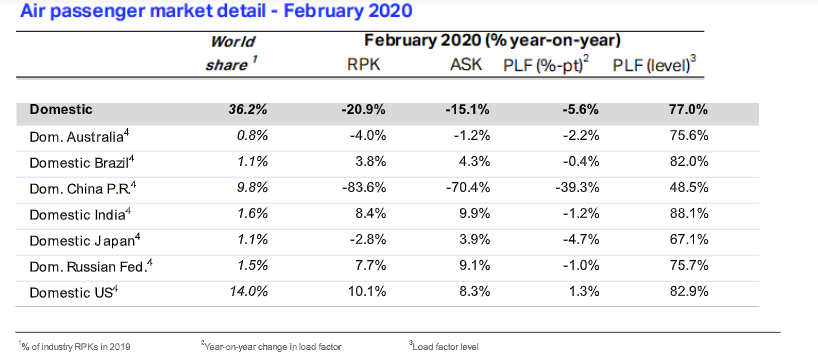

Domestic Passenger Markets

Demand for domestic travel dropped 20.9% in February compared to February 2019, as

Chinese domestic market collapsed in the face of the government lockdown. Domestic capacity

fell 15.1% and load factor dropped 5.6 percentage points to 77.0%.

Chinese airlines’ domestic traffic fell 83.6% in February, the worst outcome since IATA

began tracking the market in 2000. With the easing of some restrictions on internal travel

in March, domestic demand is showing some tentative signs of improvement.

US airlines enjoyed one of their strongest months in February, as domestic traffic

jumped 10.1%. Demand fell toward the end of the month, however, with the full impact

of COVID-19 expected to show in March results.The Bottom Line

“This is aviation’s darkest hour and it is difficult to see a sunrise ahead unless governments do

more to support the industry through this unprecedented global crisis. We are grateful to those

that have stepped up with relief measures, but many more need to do so. Our most recent

analysis shows that airlines may burn through $61 billion of their cash reserves during the

second quarter ending 30 June 2020. This includes $35 billion in sold-but-unused tickets as a

result of massive flight cancellations owing to government-imposed travel restrictions. We

welcome the actions of those regulators who have relaxed rules so as to permit airlines to issue

travel vouchers in lieu of refunds for unused tickets; and we urge others to do the same. Air

transport will play a much-needed role in supporting the inevitable recovery. But without

additional government action today, the industry will not be in a position to help when skies are

brighter tomorrow,” said de Juniac.For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.orgNotes for Editors:

IATA (International Air Transport Association) represents some 290 airlines comprising

82% of global air traffic.

You can follow us at https://twitter.com/iata for announcements, policy positions, and

other useful industry information.

All figures are provisional and represent total reporting at time of publication plus

estimates for missing data. Historic figures are subject to revision.

Domestic RPKs accounted for about 36% of the total market. It is most important for

North American airlines as it is about 66% of their operations.

Explanation of measurement terms:

o RPK: Revenue Passenger Kilometers measures actual passenger traffic

o ASK: Available Seat Kilometers measures available passenger capacity

o PLF: Passenger Load Factor is % of ASKs used.

IATA statistics cover international and domestic scheduled air traffic for IATA member

and non-member airlines.

Total passenger traffic market shares by region of carriers in terms of RPK are: Asia-

Pacific 34.7%, Europe 26.8%, North America 22.2%, Middle East 9.0%, Latin America

5.1%, and Africa 2.1%. -

PRESS RELEASE No 60 September Air Freight Volumes Remain Weak 07 November 2019 (Geneva) .

The International Air Transport Association (IATA) released data for global air freight markets showing that demand, measured in freight tonne kilometers (FTKs), decreased by 4.5% in September 2019, compared to the same period in 2018. This marks the eleventh consecutive month of year-on-year decline in freight volumes, the longest period since the global financial crisis in 2008.

Freight capacity, measured in available freight tonne kilometers (AFTKs), rose by 2.1% year-on-year in September 2019. Capacity growth has now outstripped demand growth for the 17th consecutive month.

Air cargo continues to suffer from:• the intensifying trade war between the US and China, and South Korea and Japan,• the deterioration in global trade, • and weakness in some of the key economic drivers.

Global export orders continue to fall. The Purchasing Managers Index (PMI) tracking new manufacturing export orders has pointed to falling orders since September 2018.

“The US-China trade war continues to take its toll on the air cargo industry. October’s pause on tariff hikes between Washington and Beijing is good news. But trillions of dollars of trade is already affected, which helped fuel September’s 4.5% year-on-year fall in demand. And we can expect the tough business environment for air cargo to continue,” said Alexandre de Juniac, IATA’s Director General and CEO.

Regional Performance

Airlines in Asia-Pacific, Europe, North America and the Middle East suffered sharp declines in year-on-year growth in total air freight volumes in September 2019, while Latin Americacarriers experienced a more moderate decline. Africa was the only region to record growth in air freight demand compared to September last year.

Asia-Pacific airlines saw demand for air freight contract by 4.9% in September 2019, compared to the same period in 2018. The US-China and South Korea-Japan trade wars along with the slowdown in the Chinese economy have significantly impacted this region. More recently, the disruption to operations at Hong Kong International Airport – the largest cargo hub in the world –added additional pressure. With the region accounting for more than 35% of total FTKs, this performance is the major contributor to the weak industry-wide outcome. Air freight capacity increased by 2.7% over the past year.

North American airlines saw demand decrease by 4.2% inSeptember 2019, compared to the same period a year earlier. Capacity increased by 1.9%. The US-China trade war and falling business confidence continue to weigh on the region’s carriers. Freight demand has contracted between North America and Europe and between Asia and North America.

European airlines posted a 3.3% decrease in freight demand in September 2019 compared to the same period a year earlier. Weaker manufacturing conditions for exporters in Germany, softer regional economies, and ongoing uncertainty over Brexit, have impacted the recent performance. Capacity increased by 3.3% year-on-year.

Middle Eastern airlines’ freight volumes decreased 8.0% in September 2019 compared to the year-ago period. This was the sharpest drop in freight demand of any region. Capacity decreased by 0.4%. Escalating trade tensions and the slowing in global trade have affected the region’s performance due to its strategic position as a global supply chain link. Most key routes to and from the region have seen weak demand in the past few months. The large Europe to Middle East and Asia to Middle East routes were down 8% and 5% respectively in August (last data available) compared to a year ago.

Latin American airlines experienced a decrease in freight demand in September 2019 of 0.2% compared to the same period last year and a capacity decrease of 2.9%. Despite indications of a recovery in the Brazilian economy, deteriorating conditions elsewhere in the region along with a slowing in global trade have impacted the region’s performance.

African carriers posted the fastest growth of any region in September 2019, with an increase in demand of 2.2% compared to the same period a year earlier. This was a significant slowdown in growth from the 8% recorded in August. Strong trade and investment linkages with Asia and robust economic performance in some key regional economies contributed to the positive performance. Capacity grew 9.4% year-on-year.

-

IATA realiza workshop sobre Consultation em aeroportos.

São Paulo, 28 de outubro de 2019 – A Associação Internacional de Transporte Aéreo (IATA) realiza, nos dias 29 e 30 de outubro, em São Paulo, um workshop voltado para empresas aéreas e para a Agência Nacional de Aviação Civil (Anac) sobre o processo de Consultation em aeroportos.O conceito de Consultation (ou ‘proposta apoiada’) se baseia na ideia de que as administrações aeroportuárias devem consultar as empresas aéreas antes de realizar investimentos em infraestrutura, a fim de se certificar que tais investimentos irão trazer os benefícios esperados aos seus usuários – passageiros e empresas aéreas. Com a iniciativa da IATA, será possível alinhar definições e entender o raciocínio por trás dessas consultas, expectativas, além de compreender quais são os resultados esperados pela ANAC.Além disso, o workshop visa concluir, por meio de uma estrutura ou de um processo definido, como garantir a execução adequada das consultas, incluindo funções e responsabilidades, bem como os elementos que precisam ser analisados. Nas consultas devem ser definidos, por exemplo, tráfego, análise de performance financeira e operacional, infraestrutura, nível de serviço, Capital Expenditure (CAPEX), Operational Expenditure (OPEX) e Acordo de Serviço (SLA).O workshop realizado pela IATA é uma continuação da colaboração contínua da indústria em concessões de aeroportos, como o workshop já feito em Brasília para Anac, Secretaria de Aviação Civil (SAC), Tribunal de Contas da União (TCU) e Programa de Parcerias de Investimentos (PPI), assim como visitas a aeroportos nos Estados Unidos e Europa, realizadas para ver, na prática, como um processo de Consultation se implementa. Sobre a IATAA IATA (Associação Internacional de Transporte Aéreo) representa cerca de 290 empresas aéreas que abrangem 82% do tráfego aéreo global. Para mais informações sobre a IATA visite www.iata.org.