IATA

-

September Passenger Demand Provides Solid End to Third Quarter

Open in

Web BrowserSeptember Passenger Demand Provides Solid End to Third Quarter 9 November 2023 Geneva – The International Air Transport Association (IATA) announced that the strong post-pandemic passenger traffic trend continued in September.

• Total traffic in September 2023 (measured in revenue passenger kilometers or RPKs)

rose 30.1% compared to September 2022. Globally, traffic is now at 97.3% of pre-COVID levels.

• Domestic traffic hit a new high for the month of September, as traffic rose 28.3% versus September 2022 and exceeded the September 2019 level by 5.0%.

• International traffic climbed 31.2% compared to the same month a year ago. All markets saw double-digit percentage gains year on year. International RPKs reached

93.1% of September 2019 levels.

“The third quarter of 2023 ended on a high note, with record domestic passenger demand for the month of September and continued strong international traffic,” said Willie Walsh, IATA’s Director General.Air passenger market in detail – September 2023 September 2023

(% year-on-year)World share1RPKASKPLF (%-pt)2PLF (level)3Total Market100.0%30.1%28.8%0.8%82.6%Africa2.1%24.6%27.2%-1.5%73.1%Asia Pacific22.1%87.9%75.5%5.3%80.0%Europe30.8%13.8%12.8%0.8%86.0%Latin America6.4%15.7%14.3%1.1%83.9%Middle East9.8%26.1%22.8%2.2%81.6%North America28.8%9.7%12.5%-2.1%83.0%1% of industry RPKs in 2022 2Change in load factor 3Load factor level International Passenger MarketsAsia-Pacific airlines had a 92.6% increase in September 2023 traffic compared to September 2022, continuing to lead the regions in terms of annual improvement. Capacity climbed 82.1% and the load factor increased by 4.5 percentage points to 82.5%.

European carriers’ September traffic climbed 15.7% versus September 2022. Capacity increased 14.9%, and load factor edged up 0.6 percentage points to 85.5%.

Middle Eastern airlines saw a 26.6% increase in September traffic compared to a year ago. Capacity rose 23.7% and load factor climbed 1.9 percentage points to 81.8%.

North American carriers had an 18.9% traffic rise in September 2023 versus the 2022 period. Capacity increased 18.0%, and load factor improved 0.6 percentage points to 85.6%.

Latin American airlines’ traffic rose 26.8% compared to the same month in 2022. September capacity climbed 24.7% and load factor rose 1.4 percentage points to 85.8%.

African airlines posted a 28.1% traffic increase in September 2023 versus a year ago. Capacity was up 29.9% and load factor slipped 1.0 percentage points to 72.6%.Domestic Passenger Markets

Air passenger market in detail – September 2023September 2023

(% year-on-year)World share1RPKASKPLF (%-pt)2PLF (level)3Domestic41.9%28.3%28.2%0.1%80.7%Dom. Australia4 1.0%7.2%11.7%-3.6%84.7%Dom. Brazil4 1.5%5.0%3.9%0.8%81.4%Dom. China P.R.4 6.4%168.7%135.2%9.6%76.7%Dom. India4 2.0%17.2%13.0%3.1%84.7%Dom. Japan4 1.2%19.9%4.3%9.7%74.9%Dom. US4 19.2%5.5%10.4%-3.8%81.3%1% of industry RPKs in 2022 2Change in load factor 3Load factor level

4 Note: the six domestic passenger markets for which broken-down data are available account for approximately 31.3% of global total RPKs and 74.6% of total domestic RPKsChina’s domestic market continued to perform, with demand up 168.7% year over year. This growth however is measured from a low base in September 2022, when domestic travel restrictions were reintroduced in some Chinese provinces.

Japan’s domestic traffic rebounded strongly from the impact of typhoons in August, as RPKs rose 19.9% compared to September 2022.

Air passenger market in detail – September 2023 September 2023

(% ch vs the same month in 2019)World share1RPKASKPLF (%-pt)2PLF (level)3Total Market100%-2.7%-3.5%0.7%82.6%International58.1%-6.9%-9.2%2.1%83.8%Domestic41.9%5.0%7.1%-1.6%80.7%1% of industry RPKs in 2022 2Change in load factor 3Load factor level The Bottom Line“With the end of 2023 fast approaching, we can look back on a year of strong recovery in demand as passengers took full advantage of their freedom to travel. There is every reason to believe that this momentum can be maintained in the New Year, despite economic and political uncertainties in parts of the world. But we need the whole value chain to be ready. Supply chain issues in the aircraft manufacturing sector are unacceptable. They have held back the recovery and solutions must be found. The same holds true for infrastructure providers, particularly air navigation service providers. Equipment failures, staffing shortages and labor unrest made it impossible to deliver the flying experience our customers expect. A successful 2024 needs the whole value chain to be fully prepared to handle the demand that is coming,” said Walsh.

Read the latest passenger market analysis– IATA -For more information, please contact:

Email: iata-spa@llyc.global

Notes for Editors:

• IATA (International Air Transport Association) represents some 300 airlines comprising 83% of global air traffic.

• You can follow us at https://go.updates.iata.org/e/123902/iata/j2h9b7/1606555656/ h/5_C6qqHt3fcrjbq9zsPm- T5ajrGeAJzLYr27ti5Vkjs for announcements, policy positions, and other useful industry information.

• Statistics compiled by IATA Economics using direct airline reporting complemented by estimates, including the use of FlightRadar24 data provided under license.

• All figures are provisional and represent total reporting at time of publication plus estimates for missing data. Historic figures are subject to revision.

• Domestic RPKs accounted for about 41.9% of the total market in 2022. The six domestic markets in this report account for 31.3% of global RPKs.

• Explanation of measurement terms:

o RPK: Revenue Passenger Kilometers measures actual passenger traffic

o ASK: Available Seat Kilometers measures available passenger capacity

o PLF: Passenger Load Factor is % of ASKs used.

• IATA statistics cover international and domestic scheduled air traffic for IATA member and non-member airlines.

• Total passenger traffic market shares by region of carriers for 2022 in terms of RPK are: Asia-Pacific 22.1%, Europe 30.8%, North America 28.8%, Middle East 9.8%, Latin America 6.4%, and Africa 2.1%. -

Air Cargo Contraction Eases in June .

7 August 2023 (Geneva) – The International Air Transport Association (IATA) released data for June 2023 global air cargo markets showing the smallest year-over-year contraction in demand since February 2022.Global demand, measured in cargo tonne-kilometers (CTKs), fell 3.4% in June compared to June 2022 (-3.7% for international operations). For the half year, demand slid 8.1% compared to the January-June period of 2022 (-8.7% for international operations). However, demand in June was only 2.4% below June 2019 levels (pre-pandemic).Capacity, as measured by available cargo tonne-kilometers (ACTKs), rose 9.7% compared to June 2022, which was a slower rate compared to the double-digit growth recorded between March and May. This reflects strategic capacity adjustments airlines are making amid a weakened demand environment. Capacity for the first half of 2023 was up 9.9% compared to a year ago. Capacity is now 3.7% above June 2019 (pre-pandemic) levels. Key factors influencing air cargo demand include: Global cross-border trade decreased by 2.4% year-over-year in May, reflecting the cooling demand environment and challenging macroeconomic conditions. The difference between the annual growth rates of air cargo and the global goods trade narrowed to -2.6 percentage points in May, representing the smallest gap since January 2022. However, the gap still suggests that air cargo continues to suffer more than container cargo from the slowdown in global trade.In June, both manufacturing output Purchasing Managers Index or PMI (49.2) and new export orders PMI (47.1) were below the critical threshold represented by the 50 mark, indicating a decline in global manufacturing production and exports.“We remain hopeful that the difficult trading conditions for air cargo will moderate as inflation eases in major economies. This, in turn, could encourage the central banks to loosen the money supply, which could stimulate greater economic activity,” said Willie Walsh, IATA’s Director General.

Air cargo market in detail – June 2023 World June 2023 (% year-on-year)share1CTKACTKCLF (%-pt)2CLF (level)3TOTAL MARKET100.0%-3.4%9.7%-5.8%43.2% Africa2.0%-2.8%-3.7%0.4%44.6% Asia Pacific32.4%-3.6%24.4%-13.6%46.8% Europe21.8%-2.8%4.4%-3.5%47.6% Latin America2.7%7.3%15.4%-2.5%33.7% Middle East13.0%0.5%11.1%-4.7%44.6% North America28.1% -6.5%0.7%-2.9%37.4% 1% of industry CTKs in 2022 2Year-on-year change in load factor3Load factor level

June Regional PerformanceAsia-Pacific airlines saw their air cargo volumes decrease by 3.6% in June 2023 compared to the same month in 2022. This was also a decline compared to May (-2.5%), mainly owing to weak demand on within-Asia markets, although the Asia-North America trade lane saw improved performance. Available capacity in the region increased by 24.4% compared to June 2022. Looking at the first half of 2023, cargo demand was down 6.5% versus the year-ago period against a 27.0% rise in capacity.North American carriers had a 6.5% decrease in total cargo volumes in June 2023 compared to the same month in 2022, marking the fourth consecutive month in which the region had the weakest performance. This was, however, an improvement compared to May (-8.6%). Europe-North America CTKs shrank by only 2.7% in June, following three months of double-digit contractions. Capacity increased 0.7% compared to June 2022. For the 2023 first half, cargo demand was down 10.5% compared to the 2022 first half, while capacity dipped 0.7%.European carriers experienced a 2.8% decrease in cargo volumes in June 2023, compared to the same month in 2022. This was an improvement in performance compared to May (-6.6%), in part due to the aforementioned Europe-North America performance. Capacity increased 4.4% compared to June 2022. Cargo demand was down 10.2% for the first six months of 2023 compared to last year, as the half-year capacity rose 2.5%.Middle Eastern carriers posted a 0.5% increase in cargo volumes in June 2023 versus a year ago. This was a strong turnaround from the 2.9% year-over-year decline registered in May. Capacity rose 11.1% for the month. Both Middle East-Asia and Middle East-Europe route areas saw annual growth. For the first half of the year, cargo demand was down 5.6% compared to a year ago, with an 11.2% hike in capacity.Latin American carriers had strongest performance in June 2023, with a 7.3% increase in cargo volumes compared to June 2022. This was an improvement compared to May (+3.8%). Capacity in June was up 15.4% over the same month in 2022. For the 2023 first half, cargo demand was up 0.9% versus a year ago, while capacity climbed 18.0%.African airlines posted a 2.8% decrease in demand compared to June 2022. This was a decline in performance compared to the previous month (-1.9%). Capacity in June was down 3.7% compared to the same month in 2022. For the first half of the year, cargo demand slowed by 4.4% while capacity climbed 1.6%.View June 2023 Air Cargo Market Analysis – IATA – -

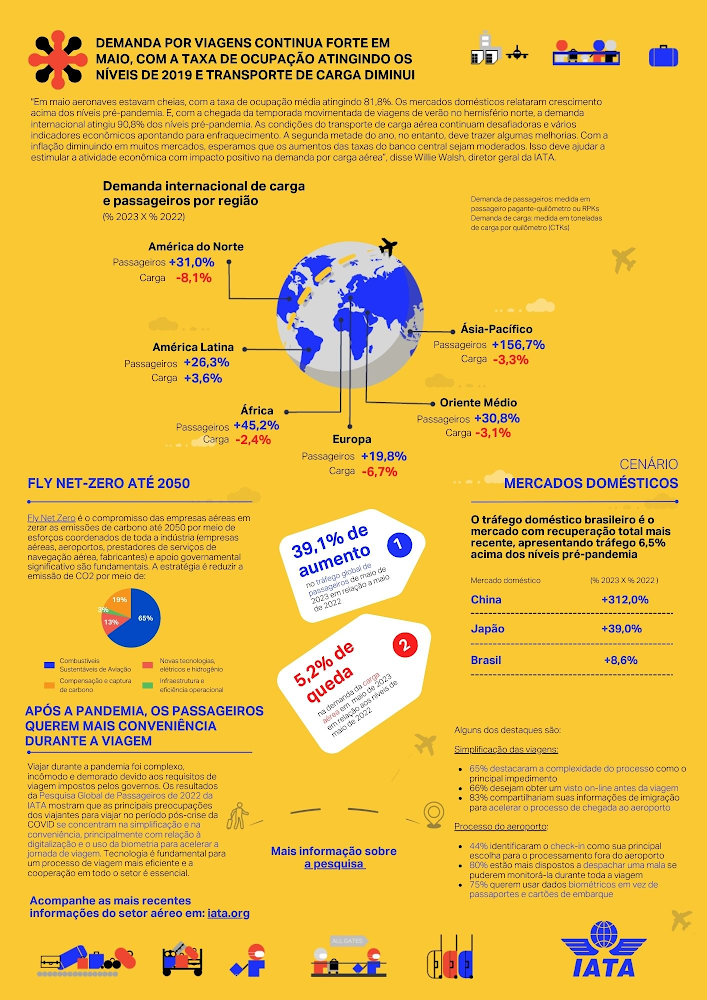

IATA – demanda de maio.

-

Ground Handling Priorities: Recruitment & Retention, Global Standards and Digitalization

16 May 2023 Abu Dhabi – The International Air Transport Association (IATA) highlighted three priorities to enable the ground handling sector to build resilience and ensure long-term sustainability. The priorities, outlined at the 35th IATA Ground Handling Conference (IGHC) which opened in Abu Dhabi today sponsored by Etihad Airways are:

Effective staff recruitment and retentionConsistent implementation of global standardsAccelerating digitalization and automation

“It’s going to be a busy peak Northern Hemisphere summer travel season for the aviation industry, and the ground handling sector will need to be ready. Short-term we must act fast to prepare for increased traffic. Ensuring efficient onboarding of new employees and working with governments to reduce bottlenecks in security clearances is critical. Longer-term, more effective staff recruitment and retention, implementing global standards and accelerating digitalization and automation will be critical to build resilience and ensure sustainability,” said Monika Mejstrikova, IATA’s Director of Ground Operations.

Effective Staff Recruitment and Retention

A recent IATA survey found that 37% of ground handling professionals anticipated staffing shortages until the end of 2023 and beyond, and 60% felt they didn’t have enough qualified staff to ensure smooth operations. Additionally, 27% of respondents feared that their current employees would leave soon.

“Creating a stable ground handling talent base is essential. And it can be achieved by making ramp work more attractive. We need to embrace automation to relieve staff from difficult and hazardous tasks, foster a culture of continuous learning and career growth and create a safe and inclusive environment for people where talents are nurtured,” said Mejstrikova.

IATA outlined a series of initiatives to help alleviate labor shortages:

Implementation of competency-based training, with more online assessments to improve speed and efficiencyMutual recognition of security training and employee background records among authorities, to expedite the recruitment process and reduce redundancyAutomation of processes to relieve people from performing physically challenging tasksPromoting career development and rewarding years of training and skills

IATA has just launched a Ground Ops Training Passport which supports staff retention and professional growth. It mutually recognizes skills and training across ground handlers, airlines, and airports to drive cross-utilization of skilled personnel.

“The real beneficiary of the training passport is the employee. They will have access to their training records, allowing them to use their knowledge and skills for ongoing professional growth. An industry-wide approach to talent development will pay big benefits in terms of efficiency for all concerned. We need to empower our employees for success,” said Mejstrikova.

Global Standardization of Processes

Global standards are the foundation for safe and efficient operations. Two key tools for ground handlers are the IATA Ground Operations Manual (IGOM) and the IATA Safety Audit for Ground Operations(ISAGO).

IGOM: IATA called for the ground handling industry to accelerate the global adoption of IGOM to ensure worldwide operational consistency and safety. To support this, IATA has launched the IGOM Portal. A user-friendly online platform where airlines and ground handlers can share the results of their gap analysis between company procedures and IGOM, offering a global benchmark for harmonization and driving efficiency. Over 140 airlines have already subscribed to its services and the Portal is now opening to ground handling service providers (GHSPs).

ISAGO: Close to 40 airports and regulators globally endorsed ISAGO to complement their monitoring /compliance, performance or licensing systems through cooperation agreements. IATA urged more governments to recognize ISAGO in their regulatory frameworks for oversight to deliver significant benefits, including greater harmonization, Safety Management System (SMS) implementation and reduction of duplicate audits.

Another area where IATA called for greater standardization is baggage. IATA is working on updating the baggage standards to reflect new developments in real-time tracking, electronic bag tags, and Bluetooth technology.

“We all know the frustration of losing luggage. And the cost to the industry is staggering. In 2019, 25.4 million bags were lost or delayed resulting in a bill of $2.5 billion. IATA is committed to improving baggage handling through collaboration and innovation,” said Mejstrikova.

Digitalization and Automation

Digitalization and automation are critical to improving both sustainability and efficiency and driving process improvements. IATA outlined three priorities:

Ramp Digitalization – IATA’s Ground Operations Digitalization and Automation Working Group (GAD) has developed the Timestamps Turnaround (XTST) message to provide standardized communication and real-time network monitoring for airlines. Implementing the XTST standard can reduce ground handling delays by up to 5% globally.

Load Control Digitalization – IATA is pioneering the automation of load control, utilizing the new X565 digital standard to reduce workload, costs, and errors while enabling real-time updates.

GSE Automation – transitioning to enhanced ground support equipment (Enhanced GSE) potentially reducing ground damage costs by 42% and creating a safer environment. Autonomous GSE trials are already underway in over 15 countries. Transitioning to Enhanced GSE not only improves safety but also reduces GSE CO2 emissions by 1.8 million tonnes annually, contributing to a more sustainable industry.

“Ground operations are complex, and delays are the bane of every turnaround coordinator’s existence. But with technology and communication advancements, we can avoid delays, make operations safer, more efficient and more environmentally sustainable, while providing a better working experience for staff on the ramp,” said Mejstrikova.

For more information, please contact:

Email: iata-pr-spa@llorenteycuenca.comNotes for Editors:

IATA (International Air Transport Association) represents some 300 airlines comprising 83% of global air traffic.You can follow us at twitter.com/iata for announcements, policy positions, and other useful industry information.Fly Net Zero -

Get Ready: Booking Data Points to Strong Peak Season Travel

16 May 2023Abu Dhabi – The International Air Transport Association (IATA) reported high levels of confidence among travelers for the peak Northern summer travel holiday season. This corresponds with first quarter 2023 forward bookings data for May – September which is tracking at 35% above 2022 levels.

The survey covering 4,700 travelers in 11 countries shows that:

79% of travelers surveyed said that they were planning a trip in the June-August 2023 periodwhile 85% said that peak travel season disruptions should not be a surprise, 80% said that they expected smooth travel with post pandemic issues having been resolved

Forward bookings data indicates that greatest growth is expected in:

Asia Pacific region (134.7%)Middle East (42.9%)Europe (39.9%)Africa (36.4%) Latin America (21.4%) North America (14.1%)

“Expectations are high for this year’s peak Northern summer travel season. For many this will be their first post-pandemic travel experience. While some disruptions can be expected, there is a clear expectation that the ramping-up issues faced at some key hub airports in 2022 will have been resolved. To meet strong demand, airlines are planning schedules based on the capacity that airports, border control, ground handlers, and air navigation service providers have declared. Over the next months, all industry players now need to deliver,” said Nick Careen, IATA’s Senior Vice President for Operations, Safety and Security.

Preparing

Collaboration, sufficient staffing and accurate information sharing are all essential to minimize operational disruptions and their impact on passengers. The key is ensuring that the capacities which have been declared and scheduled are available.

“A lot of work has gone into preparing for the peak Northern summer travel season. Success rests on readiness across all players in the supply chain. If each player delivers on what has been declared, there should be no last minute requirements to reduce the scale of the schedules that travelers have booked on,” said Careen.

Labor unrest, particularly in France, is cause for concern. Eurocontrol data on the impact of French strikes earlier this year shows that cancellations can spike by over a third.

“We need to keep a very careful eye on Europe where strike actions have caused significant disruptions earlier this year. Governments should have effective contingency plans in place so that the actions of those providing essential services like air traffic control maintain minimum service levels and do not disrupt the hard-earned vacations of those traveling or put at risk the livelihoods of those in the travel and tourism sectors,” said Careen.

For more information, please contact:

Email: iata-pr-spa@llorenteycuenca.comNotes for Editors:IATA (International Air Transport Association) represents some 300 airlines comprising 83% of global air traffic.You can follow us at twitter.com/iata for announcements, policy positions, and other useful industry information.Fly Net Zero