IATA release – Demanda de carga para o mês de março e novas datas da 76ª Reunião Geral Anual (AGM)

NEWS

No: 35

November Dates for IATA’s 76 th AGM

28 April 2020 (Geneva) The International Air Transport Association (IATA) announced that its

rescheduled 76 th Annual General Meeting (AGM) and World Air Transport Summit will take

place in Amsterdam, the Netherlands on 23-24 November 2020.

IATA’s 76 th AGM and World Air Transport Summit will be hosted by KLM Royal Dutch Airlines at

the RAI Convention Centre. The dates were selected in anticipation that government restrictions

on travel will have been lifted and that the public health authorities in the Netherlands will permit

large gatherings at that time. IATA will work with public health authorities to ensure that all

precautions are taken for the meeting to be held safely.

“The fight against COVID-19 is the world’s top priority. The economic and social cost of beating

the virus will be high. The extreme financial difficulty of the airline industry is a prime example of

that. In the post-pandemic world, a viable air transport industry will be critical. It will be a leader

in the economic recovery by performing its traditional role of linking people, goods and

businesses globally. But we will be a changed industry. In anticipation that the world will have

returned to sufficient normality by November, we will gather the world’s airlines to look ahead

together as we address the biggest challenges we have ever faced. Aviation is the business of

freedom. We are resilient. And this AGM will help us to build an even stronger future,” said

Alexandre de Juniac, IATA’s Director General and CEO.

- IATA –

For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

Notes for Editors:

IATA (International Air Transport Association) represents some 290 airlines comprising

82% of global air traffic.

You can follow us at twitter.com/iata for announcements, policy positions, and other

useful industry information.

Immediate and Severe Air Cargo Capacity Crunch

28 April 2020 (Geneva) – The International Air Transport Association (IATA) released data for March air cargo

performance demonstrating a severe capacity shortfall.

Global demand, measured in cargo tonne kilometers (CTKs*), fell by 15.2% in March compared to the

previous year (-15.8% for international markets).

Global capacity, measured in available cargo tonne kilometers (ACTKs), shrank by 22.7% in March

compared to the previous year (-24.6% for international markets).

International markets account for 87% of air cargo. Belly capacity for international air cargo shrank by

43.7% in March compared to the previous year. This was partially offset by a 6.2% increase in capacity

through expanded use of freighter aircraft, including the use of idle passenger aircraft for all-cargo

operations.

“At present, we don’t have enough capacity to meet the remaining demand for air cargo. Volumes fell by over

15% in March compared to the previous year. But capacity plummeted by almost 23%. The gap must be

addressed quickly because vital supplies must get to where they are needed most. For example, there is a

doubling of demand for pharmaceutical shipments that are critical to this crisis. With most of the passenger fleet

sitting idle, airlines are doing their best to meet demand by adding freighter services, including adapting

passenger aircraft to all-cargo activity. But mounting these special operations continues to face bureaucratic

hurdles. Governments must cut the red tape needed to approve special flights and ensure safe and efficient

facilitation of crew,” said Alexandre de Juniac, IATA’s Director General and CEO.

There are still too many examples of delays in getting charter permits issued, a lack of exemptions on COVID-19

testing for air cargo crew, and inadequate ground infrastructure to/from and within airport environments. Air cargo

needs to move efficiently throughout the entire supply chain to be effective. IATA urges governments to:

Cut the paperwork for charter operations

Exempt cargo crew from quarantine rules that apply to the general population

Ensure there is adequate staff and facilities to process cargo efficiently

Slow Recovery

While there is an immediate capacity shortage, the collapsing economy is expected to further depress overall

cargo volumes.

Short-term analysis shows that global manufacturing activity continued to contract in March as government-

imposed lockdowns caused widespread disruptions. Following the sharp decline in February – which exceeded

that of the global financial crisis – the global manufacturing Purchasing Managers’ Index (PMI) rose slightly in

March but remained in contractionary territory. This improvement was due to the stabilization of the China PMI;

excluding the China outcome, the global index fell to its lowest level since May 2009.

Looking at the prospects for the rest of 2020, the World Trade Organization forecast gives little indication of a

quick recovery. The optimistic scenario is for a 13% fall in trade in 2020, while the pessimistic scenario sees a

32% fall in trade in 2020. This will deeply impact air cargo’s prospects.

One area of demand, however, is growing sharply. Pharmaceutical shipments are tracking at double previous-

year volumes. This excludes shipments of medical equipment.

“The capacity crunch will, unfortunately, be a temporary problem. The recession will likely hit air cargo at least as

severely as it does the rest of the economy. To keep the supply chain moving to meet what demand might exist,

airlines must be financially viable. The need for financial relief for airlines by whatever means possible remains

urgent,” said de Juniac.

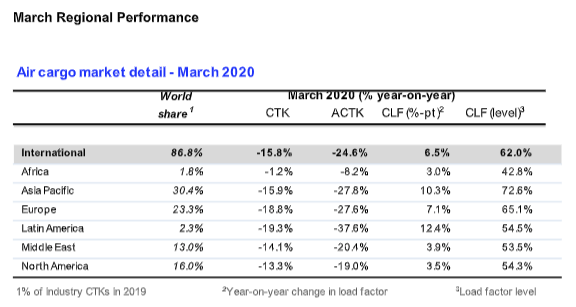

March Regional Performance

March 2020 (% year-on-year)% 2019

Note: the total industry and regional growth rates are based on a constant sample of airlines combining reported data and estimates for missing observations. Airline traffic is allocated

according to the region in which the carrier is registered; it should not be considered as regional traffic. Historical statistics are subject to revision.

Asia-Pacific airlines saw demand for international air cargo fall by 15.9% in March 2020, compared to the year-

earlier period. Seasonally adjusted cargo demand fell by 3.0% compared to February 2020, to levels last seen in

the third quarter of 2013. International capacity decreased 27.8%.

North American carriers reported a decline in international demand of 13.3% annually in March which was more

than double the pace of decline in February (-6.1%). Cargo volumes on the Europe-North America trade lane

were affected the most (down 22% year-on-year) in March. International capacity decreased 19%.

European carriers reported an 18.8% annual drop in international cargo volumes in March, much sharper than

the outcome for February (-5.2%). Intra-Europe demand declined by 32.6% year-on-year due to widespread

shutdowns in the manufacturing sector across the region. The larger Europe-North America and Europe-Asia

markets also recorded substantial declines this month. International capacity decreased 27.6%.

Middle Eastern carriers reported a decline of 14.1% year-on-year following growth of 4.3% in February. Among

all routes to/from the Middle East, the sizeable Europe and Asia trade lanes recorded falls in the order of 20% in

March, while the smaller Africa market saw a decline of around 30%. International capacity decreased 20.4%.

Latin American carriers posted the sharpest fall—a 19.3% year-on-year decline in international demand. This

was a significant deterioration compared to February (-0.5%). Declines were widespread but most severe for

Central-South America with volumes down around 35% year-on-year. International capacity decreased 37.6%.

African airlines were less affected by disruptions in March. They saw year-on-year growth in international CTKs

fall by 1.2% following the positive annual outcomes in January and February. The Africa-Asia market was the only

trade lane which continued to post growth in March, with volumes up almost 10% year-on-year. International

capacity decreased 8.2%.

View March Freight Results (pdf)

View the COVID-19 Assessing prospects for air cargo report

Read remarks of Alexandre de Juniac

- IATA –

For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

Notes for Editors:

Please note that as of January 2020 onwards, we have clarified the terminology of the Industry and

Regional series from ‘Freight’ to ‘Cargo’ [the corresponding metrics being FTK (changed to ‘CTK’), AFTK

(changed to ‘ACTK’), and FLF (changed to ‘CLF’)], in order to reflect that the series have been consisting

of Cargo (Freight plus Mail) rather than Freight. The data series themselves have not been changed.

Airline individual data retain the FTK metric.

IATA (International Air Transport Association) represents some 290 airlines comprising 82% of global air

traffic.

You can follow us at twitter.com/iata for announcements, policy positions, and other useful industry

information.

Explanation of measurement terms:

o CTK: cargo tonne kilometers measures actual freight traffic

o ACTK: available cargo tonne kilometers measures available total freight capacity

o CLF: freight load factor is % of ACTKs used

IATA statistics cover international and domestic scheduled air freight for IATA member and non-member

airlines.

Total freight traffic market shares by region of carriers in terms of CTK are: Asia-Pacific 34.5%, Europe

23.6%, North America 24.3%, Middle East 13.0%, Latin America 2.8%, and Africa 1.8%.