aeroportos

-

Aero Service inaugura base em Confins e faz novas contratações

A Aero Service, empresa especializada em assessoria de viagens, inaugura nesta terça (1/11), sua base própria no Aeroporto Internacional de Confins, em Minas Gerais. A base funcionará de segunda a sexta das 8hs às 17hs e aos finais de semana mediante agendamento. O responsável pelo atendimento será Ivan Luís da Silva, ex-funcionário da Azul, que atuará como atendente auxiliando no embarque e desembarque de passageiros.

A companhia já atuava em Minas Gerais com parceiros, sendo que Ivan será o primeiro colaborador fixo da empresa em Confins, mas espera-se que haja mais contratações no aeroporto em breve. A inauguração da base própria da Aero Service faz parte dos planos da empresa de ampliar os serviços em diversos aeroportos do país.

Para otimizar o atendimento, a companhia também contratou recentemente Maria Eduarda Capitani, que passou a atuar no final de outubro no escritório da empresa em Guarulhos, na área de agendamento.

“O serviço da Aero Service consiste em uma melhoria para o passageiro. A gente é um braço da agência de viagem e a partir do momento que a agência contrata o nosso serviço, eles sabem que a gente vai dar uma segurança maior na viagem para o passageiro”, diz Matheus Aquino, diretor executivo da Aero Service.

Mais informações sobre a empresa através do telefone (11) 2382-6089, do site aeroservice.tur.br e do instagram @aeroservice_

Foto destaque por: Divulgação

-

Aero Service esclarece como auxiliar passageiros idosos e com deficiência nos aeroportos

A Aero Service é uma empresa especializada no atendimento de embarque e desembarque, operando nos principais aeroportos do Brasil. Além de realizar assessoria de viagens, a empresa oferece também serviços de transporte executivo, organização e coordenação de eventos em aeroportos e hotéis, coordenação de grupos de intercâmbio, atendimentos corporativos, além de transfer de alto padrão com automóveis blindados. Com uma equipe completa de profissionais, a Aero Service realiza com ampla experiência todo e qualquer serviço para agilizar o embarque e desembarque de passageiros individuais, em grupo ou corporativos. A Aero Service está presente nos aeroportos de Guarulhos, Congonhas e Viracopos em São Paulo, Galeão e Santos Dumont no Rio de Janeiro, além de Brasília, Porto Alegre, Salvador, Curitiba, Recife e Confins em Belo Horizonte.

VOCÊ SABIA?

Que os passageiros na melhor idade podem ser ajudados em cada passo, desde o check-in até o desembarque – seja por questões de locomoção, realização dos procedimentos de check-in, despacho de bagagem, verificação de segurança, embarque, serviços durante o voo, escalas e conexões, desembarque e recuperação de bagagem.

Passageiros portadores de deficiência

Para ter a permissão de viajar sozinha, a pessoa com deficiência deve ser capaz de usar o banheiro de forma independente, comer uma refeição sozinha, aplicar sozinha a medicação e usar a máscara de oxigênio independentemente. No caso de uma deficiência que não permita a realização de quaisquer dos pontos acima, o passageiro deve ser acompanhado por outra pessoa que tenha mais do que 16 anos e esteja fisicamente apta.

Qualquer viajante portador de deficiência de locomoção pode solicitar uma cadeira de rodas para a companhia aérea. Esse passageiro pode também, despachar sua cadeira de rodas, andador ou bengala gratuitamente.

Portadores de deficiências cognitivas / intelectuais também têm o direito de serem acompanhados e orientados durante todo o processo da viagem, da chegada ao aeroporto de embarque até a saída do aeroporto de destino.

Necessidades especiais devem ser informadas antecipadamente. Também, é possível que a companhia aérea peça um atestado médico que comprove que a pessoa pode viajar de avião.

Primeira viagem de avião

Se você vai fazer sua primeira viagem de avião, também pode contar com a assistência da Aero Service para garantir uma ótima primeira experiência. Conte com a empresa para passar pelos procedimentos de check-in, verificação de segurança e embarque. Solicite esse auxílio tirando suas dúvidas com a Aero Service.

Mais informações aeroservice.tur.br e @aeroservice_

Foto destaque por: Divulgação

-

Aero Service deve dobrar número de atendimentos

A Aero Service, empresa especializada em assessoria de viagens, está trabalhando para dobrar o número de passageiros atendidos nos aeroportos do país. De setembro de 2021 a setembro de 2022 foram 8500 atendimentos. A expectativa é aumentar esse número para 17 a 20 mil pessoas assessoradas nos próximos 12 meses.

Além de novas negociações e prospecções, a época de intercâmbios, que se inicia em novembro, e a de férias também devem beneficiar a empresa, ajudando a elevar o número de clientes.

Atualmente a empresa conta com uma média de 900 atendimentos por mês. Esse número vem sendo mantido, pois a companhia atua tanto com clientes que viajam a lazer quanto clientes do mundo corporativo, fazendo com que a empresa não seja afetada pela baixa temporada.

Os serviços oferecidos pela Aero Service são: assessoria de viagens nos principais aeroportos do país, transportes executivos, organização e coordenação de eventos em aeroportos e hotéis, coordenação de grupos de intercâmbio e grupos de incentivo e atendimentos corporativos. Além disso, a empresa oferece transfer de alto padrão com veículos convencionais e blindados. A parte do transporte foi introduzida na lista de serviços após a pandemia, com o objetivo de oferecer um serviço completo ao cliente.

“Um de nossos diferenciais é o bom relacionamento que a gente tem com a companhia aérea, além da atenção que temos com a agência de viagens, porque hoje, independente do passageiro e sua categoria, todos são tratados com cuidados especiais e máxima atenção”, diz Matheus Aquino, diretor executivo da Aero Service.

“Além disso, considero um forte diferencial em nosso atendimento o fato de torná-lo o mais personalizado possível, uma vez que fazemos questão de ter o contato do passageiro ou de seu motorista para que possamos marcar o ponto de encontro, aguardá-lo do lado de fora, recepcioná-los no carro, auxiliá-los com as bagagens, além de todo procedimento de checagem de reserva, marcação de assento que já fizemos antes do mesmo chegar”, complementa Joseane Azevedo, diretora administrativa da Aero Service.

Apesar de atuar em sua maioria com o público oriundo de agência de viagens, representando uma média de 90% de atendimentos, a empresa também presta serviços para clientes particulares. Quem viaja com a assessoria da empresa pode usufruir de comodidades como transporte até o aeroporto, auxílio com a bagagem e funcionários à disposição nos aeroportos, que são altamente treinados para resolver qualquer tipo de imprevisto.

“Somos um complemento da agência de viagens, pois a mesma vai entregar um serviço completo para o passageiro, que vai livrá-los de qualquer preocupação. Ele não vai chegar ao aeroporto e ter problema de overbooking ou de falta de assento. Qualquer problema que possa vir a acontecer quando ele for fazer o check in, nós já teremos resolvido antes de ele chegar”, finaliza Joseane.

Para saber mais sobre a empresa acesse: aeroservice.tur.br

-

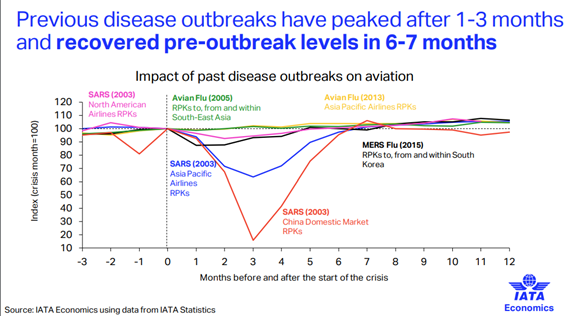

COVID-19 Hits January Passenger Demand

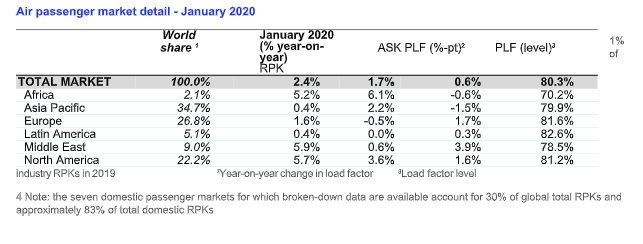

4 March 2020 (Geneva) – The International Air Transport Association (IATA) announced global

passenger traffic data for January 2020 showing that demand (measured in total revenue

passenger kilometers or RPKs) climbed 2.4% compared to January 2019. This was down from

4.6% year-over-year growth for the prior month and is the lowest monthly increase since April

2010, at the time of the volcanic ash cloud crisis in Europe that led to massive airspace closures

and flight cancellations. January capacity (available seat kilometers or ASKs) increased by

1.7%. Load factor climbed 0.6 percentage point to 80.3%.

“January was just the tip of the iceberg in terms of the traffic impacts we are seeing owing to the

COVID-19 outbreak, given that major travel restrictions in China did not begin until 23 January.

Nevertheless, it was still enough to cause our slowest traffic growth in nearly a decade,” said

Alexandre de Juniac, IATA’s Director General and CEO.

International Passenger Markets

January international passenger demand rose 2.5% compared to January 2019, down from

3.7% growth the previous month. With the exception of Latin America, all regions recorded

increases, led by airlines in Africa and the Middle East that saw minimal impact from the

COVID-19 outbreak in January. Capacity climbed 0.9%, and load factor rose 1.2 percentage

points to 81.1%.

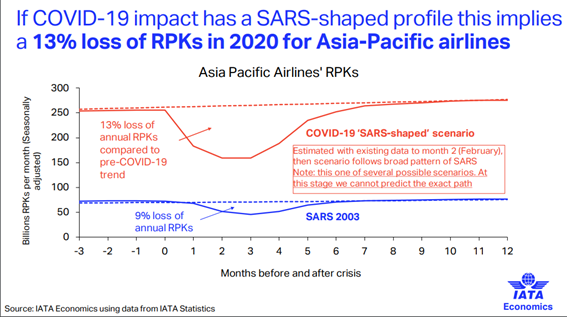

Asia-Pacific airlines’ January traffic climbed 2.5% compared to the year-ago period,

which was the slowest outcome since early 2013 and a decline from the 3.9% increase

in December. Softer GDP growth in several of the region’s key economies was

compounded by COVID-19 impacts on the international China market. Capacity rose

3.0% and load factor slid 0.4 percentage point to 81.6%.

European carriers saw January demand climb just 1.6% year-to-year, down from 2.7%

in December. Results were impacted by slumping GDP growth in leading economies

during the 2019 fourth quarter plus flight cancellations related to COVID-19 in late

January. Capacity fell 1.0%, and load factor lifted 2.1 percentage points to 82.7%.

Middle Eastern airlines posted a 5.4% traffic increase in January, the fourth

consecutive month of solid demand growth, reflecting strong performance from larger

Europe-Middle East and Middle East-Asia routes, which were not significantly impacted

by route cancellations related to COVID-19 at that time. Capacity increased just 0.5%,

with load factor jumping 3.6 percentage points to 78.3%.

North American carriers’ international demand rose 2.9% compared to January a year

ago, which represented a slowdown from the 5.2% growth recorded in December,

although there were no significant flight cancellations to Asia in January. Capacity

climbed 1.6%, and load factor grew by 1.0 percentage point to 81.7%.

Latin American airlines experienced a 3.7% demand drop in January compared to the

same month last year, which was a further deterioration compared to a 1.3% decline in

December. Traffic for Latin American carriers has now been particularly weak for four

consecutive months, reflecting continued social unrest and economic difficulties in a

number of countries in the region unrelated to COVID-19. Capacity fell 4.0% and load

factor edged up 0.2 percentage point to 82.7%.African airlines’ traffic climbed 5.3% in January, up slightly from 5.1% growth in

December. Capacity rose 5.7%, however, and load factor slipped 0.3 percentage point

to 70.5%.

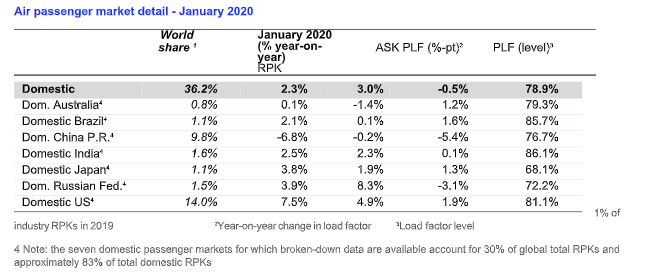

Domestic Passenger Markets

Demand for domestic travel climbed 2.3% in January compared to January 2019, as strong

growth in the US helped mitigate the impact from a steep decline in China’s domestic traffic.

Capacity rose 3.0% and load factor dipped 0.5 percentage point to 78.9%.

Chinese airlines’ domestic traffic fell 6.8% in January, reflecting the impact of flight

cancellations and travel restrictions related to COVID-19. China’s Ministry of Transport

reported an 80% annual fall in volumes in late January and early February. Capacity

slipped 0.2% and passenger load factor plunged 5.4 percentage points to 76.7%.

US airlines saw domestic traffic climb 7.5% in January. Although this was down from

10.1% growth in December, it represented another strong month of demand growth

reflecting supportive business confidence and domestic economic outcomes at the time.

Capacity rose 4.9% and load factor climbed 1.9 percentage points to 81.1%.

The Bottom Line

“The COVID-19 outbreak is a global crisis that is testing the resilience not only of the airline

industry but of the global economy. Airlines are experiencing double-digit declines in demand,

and on many routes traffic has collapsed. Aircraft are being parked and employees are being

asked to take unpaid leave. In this emergency, governments need to consider the maintenanceof air transport links in their response. Suspension of the 80/20 slot use rule, and relief on

airport fees at airports where demand has disappeared are two important steps that can help

ensure that airlines are positioned to provide support during the crisis and eventually in the

recovery,” said de Juniac.For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.orgNotes for Editors:

IATA (International Air Transport Association) represents some 290 airlines comprising

82% of global air traffic.

You can follow us at https://twitter.com/iata for announcements, policy positions, and

other useful industry information.

All figures are provisional and represent total reporting at time of publication plus

estimates for missing data. Historic figures are subject to revision.

Domestic RPKs accounted for about 36% of the total market. It is most important for

North American airlines as it is about 66% of their operations.

Explanation of measurement terms:

o RPK: Revenue Passenger Kilometers measures actual passenger traffic

o ASK: Available Seat Kilometers measures available passenger capacity

o PLF: Passenger Load Factor is % of ASKs used.

IATA statistics cover international and domestic scheduled air traffic for IATA member

and non-member airlines.

Total passenger traffic market shares by region of carriers in terms of RPK are: Asia-

Pacific 34.7%, Europe 26.8%, North America 22.2%, Middle East 9.0%, Latin America

5.1%, and Africa 2.1%. -

IATA release – COVID19

IATA Updates COVID-19 Financial Impacts

-Relief Measures Needed-

5 March 2020 (Singapore) The International Air Transport Association (IATA) updated its

analysis of the financial impact of the novel coronavirus (COVID-19) public health emergency on

the global air transport industry. IATA now sees 2020 global revenue losses for the passenger

business of between $63 billion (in a scenario where COVID-19 is contained in current markets

with over 100 cases as of 2 March) and $113 billion (in a scenario with a broader spreading of

COVID-19). No estimates are yet available for the impact on cargo operations.

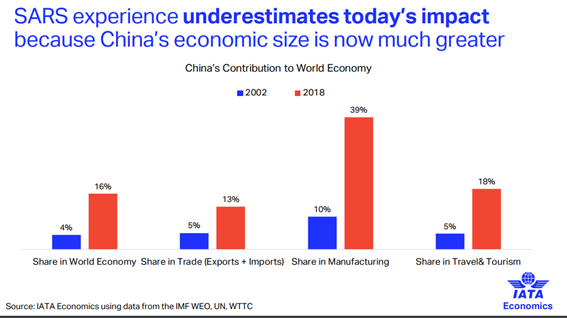

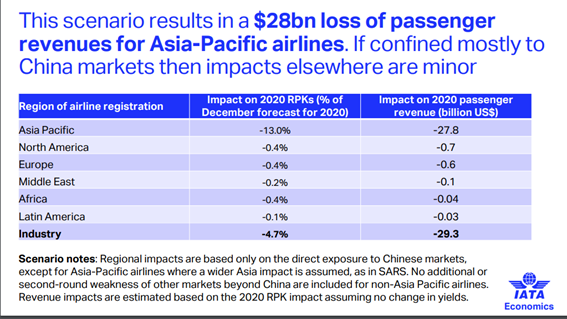

IATA’s previous analysis (issued on 20 February 2020) put lost revenues at $29.3 billion based

on a scenario that would see the impact of COVID-19 largely confined to markets associated

with China. Since that time, the virus has spread to over 80 countries and forward bookings

have been severely impacted on routes beyond China.

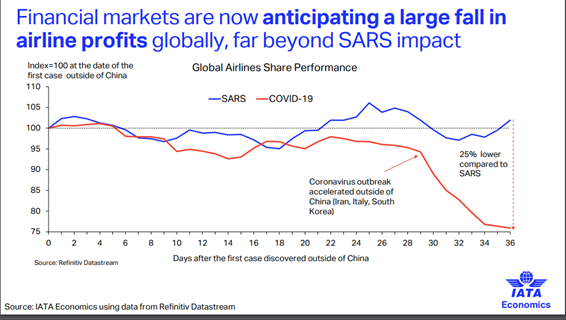

Financial markets have reacted strongly. Airline share prices have fallen nearly 25% since the

outbreak began, some 21 percentage points greater than the decline that occurred at a similar

point during the SARS crisis of 2003. To a large extent, this fall already prices in a shock to

industry revenues much greater than our previous analysis.

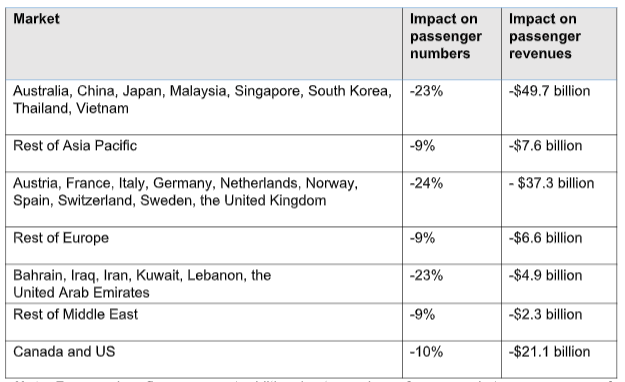

To take into account the evolving situation with COVID-19, IATA estimated the potential impact

on passenger revenues based on two possible scenarios:

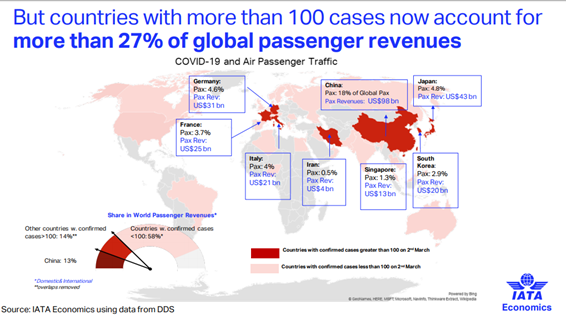

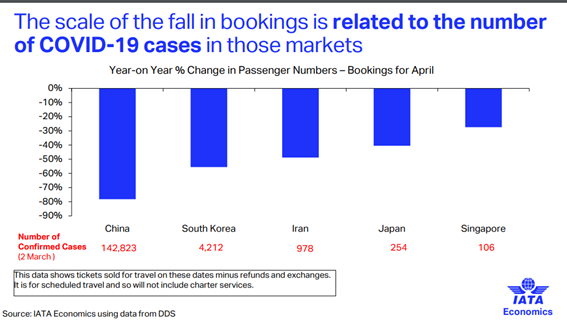

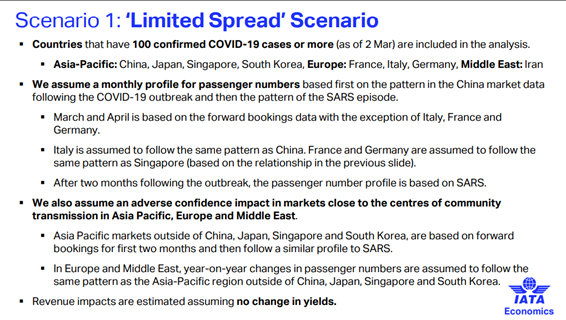

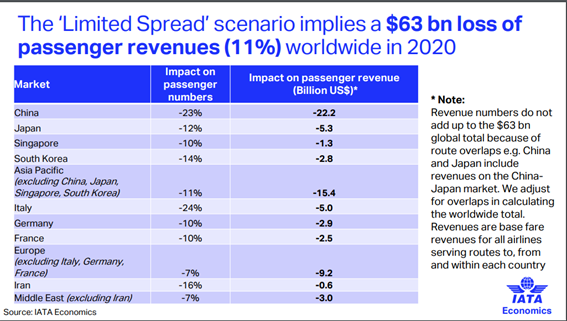

Scenario 1: Limited Spread

This scenario includes markets with more than 100 confirmed COVID-19 cases (as of 2 March)

experiencing a sharp downturn followed by a V-shaped recovery profile. It also estimates falls in

consumer confidence in other markets (North America, Asia Pacific and Europe).

The markets accounted for in this scenario and their anticipated fall in passenger numbers, due

to COVID-19, as are as follows: China (-23%), Japan (-12%), Singapore (-10%), South Korea (-

14%), Italy (-24%), France (-10%), Germany (-10%), and Iran (-16%). Additionally, Asia

(excluding China, Japan, Singapore and South Korea) would be expected to see an 11% fall in

demand. Europe (excluding Italy, France and Germany) would see a 7% fall in demand and

Middle East (excluding Iran) would see a 7% fall in demand.

Globally, this fall in demand translates to an 11% worldwide passenger revenue loss equal to

$63 billion. China would account for some $22 billion of this total. Markets associated with Asia

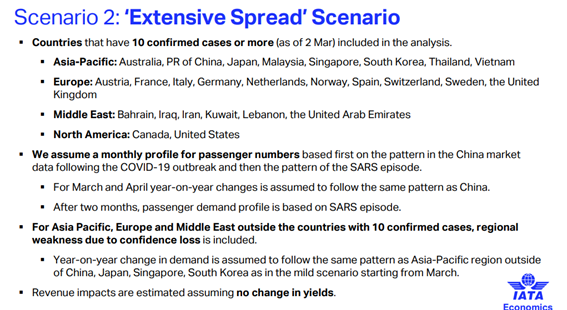

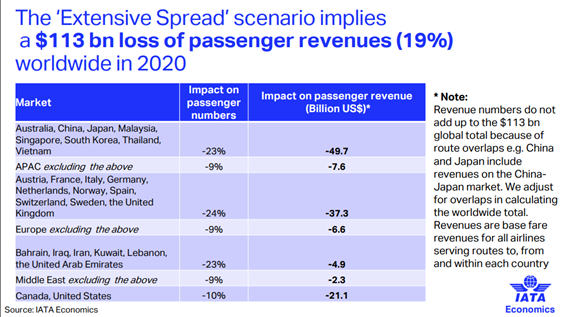

(including China) would account for $47 billion of this total.Scenario 2: Extensive Spread

This scenario applies a similar methodology but to all markets that currently have 10 or more

confirmed COVID-19 cases (as of 2 March). The outcome is a 19% loss in worldwide passenger

revenues, which equates to $113 billion. Financially, that would be on a scale equivalent to what

the industry experienced in the Global Financial Crisis.

Note: Revenue loss figures are not additive due to overlaps of some markets, e.g., revenues for

China and Germany both contain the revenues for the China-Germany market. Revenues are

base fare revenues for all airlines flying to, from and within the country.Africa and Latin America/Caribbean regions are not explicitly included in this market-based

analysis, because there are currently no countries in either region with at least 10 COVID-19

cases.

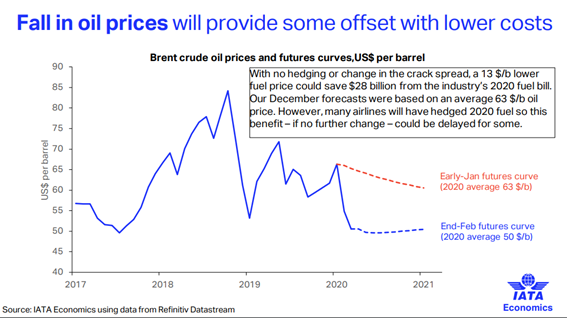

Mitigation

Oil prices have fallen significantly (-$13/barrel Brent) since the beginning of the year. This could

cut costs up to $28 billion on the 2020 fuel bill (on top of those savings which would be achieved

as a result of reduced operations) which would provide some relief but would not significantly

cushion the devastating impact that COVID-19 is having on demand. And it should be noted that

hedging practices will postpone this impact for many airlines.

Impact

“The turn of events as a result of COVID-19 is almost without precedent. In little over two

months, the industry’s prospects in much of the world have taken a dramatic turn for the worse.

It is unclear how the virus will develop, but whether we see the impact contained to a fewmarkets and a $63 billion revenue loss, or a broader impact leading to a $113 billion loss of

revenue, this is a crisis.

“Many airlines are cutting capacity and taking emergency measures to reduce costs.

Governments must take note. Airlines are doing their best to stay afloat as they perform the vital

task of linking the world’s economies. As governments look to stimulus measures, the airline

industry will need consideration for relief on taxes, charges and slot allocation. These are

extraordinary times,” said Alexandre de Juniac, IATA’s Director General and CEO.- IATA –

For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

Notes for Editors:

IATA (International Air Transport Association) represents some 290 airlines comprising

82% of global air traffic.

You can follow us at twitter.com/iata for announcements, policy positions, and other

useful industry information.