IATA release – COVID19

IATA Updates COVID-19 Financial Impacts

-Relief Measures Needed-

5 March 2020 (Singapore) The International Air Transport Association (IATA) updated its

analysis of the financial impact of the novel coronavirus (COVID-19) public health emergency on

the global air transport industry. IATA now sees 2020 global revenue losses for the passenger

business of between $63 billion (in a scenario where COVID-19 is contained in current markets

with over 100 cases as of 2 March) and $113 billion (in a scenario with a broader spreading of

COVID-19). No estimates are yet available for the impact on cargo operations.

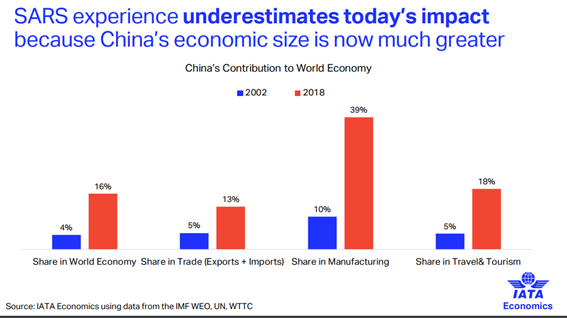

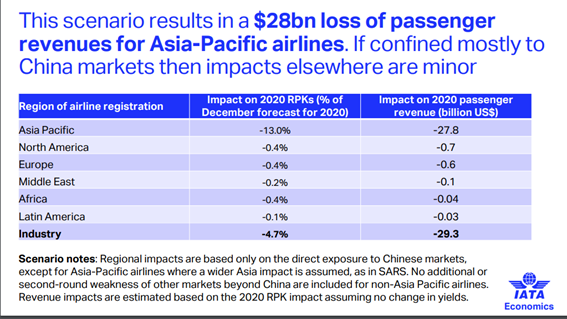

IATA’s previous analysis (issued on 20 February 2020) put lost revenues at $29.3 billion based

on a scenario that would see the impact of COVID-19 largely confined to markets associated

with China. Since that time, the virus has spread to over 80 countries and forward bookings

have been severely impacted on routes beyond China.

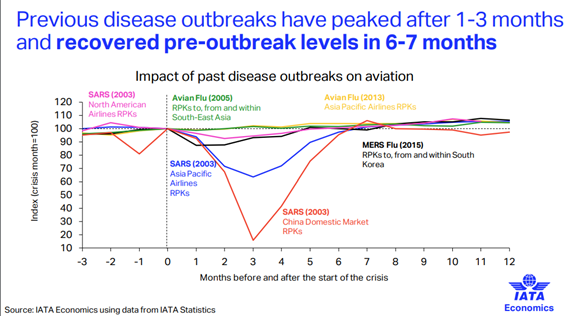

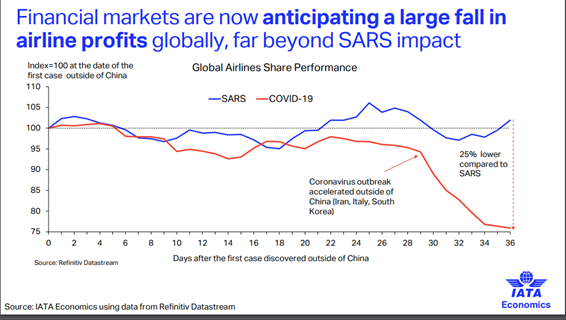

Financial markets have reacted strongly. Airline share prices have fallen nearly 25% since the

outbreak began, some 21 percentage points greater than the decline that occurred at a similar

point during the SARS crisis of 2003. To a large extent, this fall already prices in a shock to

industry revenues much greater than our previous analysis.

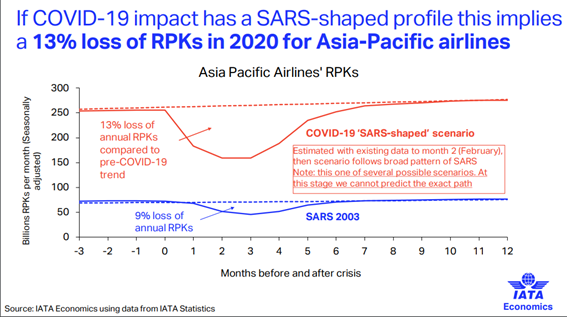

To take into account the evolving situation with COVID-19, IATA estimated the potential impact

on passenger revenues based on two possible scenarios:

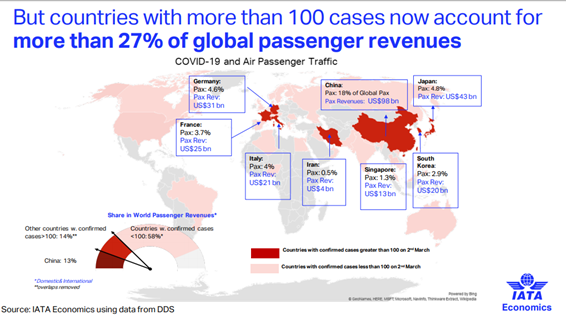

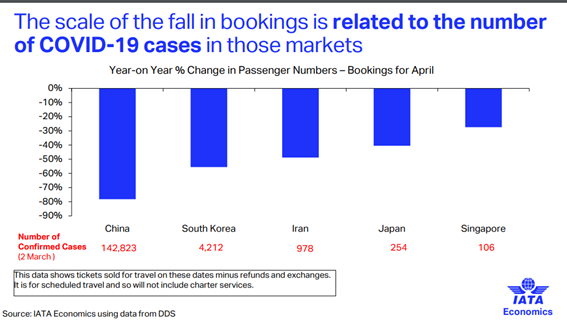

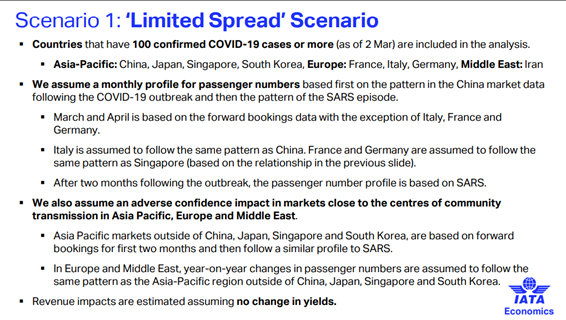

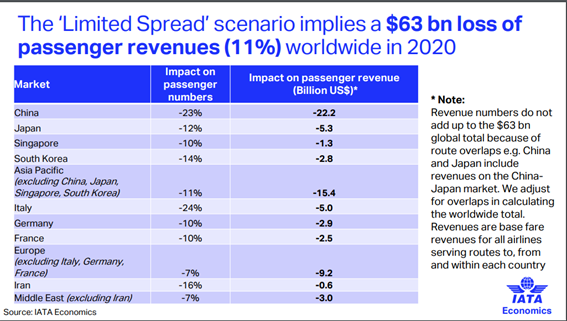

Scenario 1: Limited Spread

This scenario includes markets with more than 100 confirmed COVID-19 cases (as of 2 March)

experiencing a sharp downturn followed by a V-shaped recovery profile. It also estimates falls in

consumer confidence in other markets (North America, Asia Pacific and Europe).

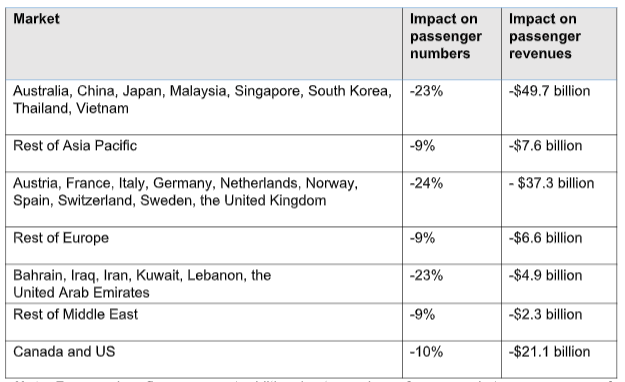

The markets accounted for in this scenario and their anticipated fall in passenger numbers, due

to COVID-19, as are as follows: China (-23%), Japan (-12%), Singapore (-10%), South Korea (-

14%), Italy (-24%), France (-10%), Germany (-10%), and Iran (-16%). Additionally, Asia

(excluding China, Japan, Singapore and South Korea) would be expected to see an 11% fall in

demand. Europe (excluding Italy, France and Germany) would see a 7% fall in demand and

Middle East (excluding Iran) would see a 7% fall in demand.

Globally, this fall in demand translates to an 11% worldwide passenger revenue loss equal to

$63 billion. China would account for some $22 billion of this total. Markets associated with Asia

(including China) would account for $47 billion of this total.

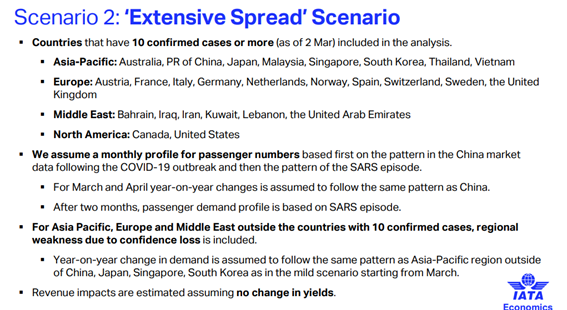

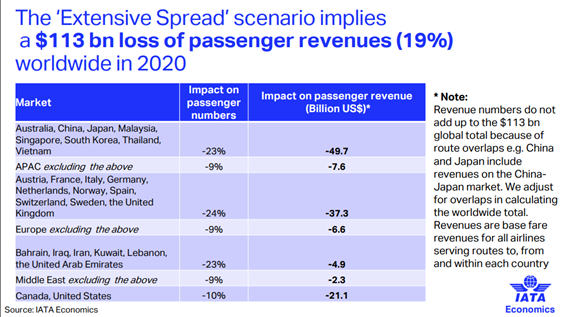

Scenario 2: Extensive Spread

This scenario applies a similar methodology but to all markets that currently have 10 or more

confirmed COVID-19 cases (as of 2 March). The outcome is a 19% loss in worldwide passenger

revenues, which equates to $113 billion. Financially, that would be on a scale equivalent to what

the industry experienced in the Global Financial Crisis.

China and Germany both contain the revenues for the China-Germany market. Revenues are

base fare revenues for all airlines flying to, from and within the country.

Africa and Latin America/Caribbean regions are not explicitly included in this market-based

analysis, because there are currently no countries in either region with at least 10 COVID-19

cases.

Mitigation

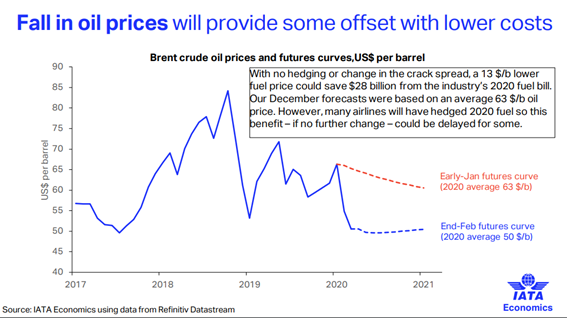

Oil prices have fallen significantly (-$13/barrel Brent) since the beginning of the year. This could

cut costs up to $28 billion on the 2020 fuel bill (on top of those savings which would be achieved

as a result of reduced operations) which would provide some relief but would not significantly

cushion the devastating impact that COVID-19 is having on demand. And it should be noted that

hedging practices will postpone this impact for many airlines.

Impact

“The turn of events as a result of COVID-19 is almost without precedent. In little over two

months, the industry’s prospects in much of the world have taken a dramatic turn for the worse.

It is unclear how the virus will develop, but whether we see the impact contained to a few

markets and a $63 billion revenue loss, or a broader impact leading to a $113 billion loss of

revenue, this is a crisis.

“Many airlines are cutting capacity and taking emergency measures to reduce costs.

Governments must take note. Airlines are doing their best to stay afloat as they perform the vital

task of linking the world’s economies. As governments look to stimulus measures, the airline

industry will need consideration for relief on taxes, charges and slot allocation. These are

extraordinary times,” said Alexandre de Juniac, IATA’s Director General and CEO.

- IATA –

For more information, please contact:

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

Notes for Editors:

IATA (International Air Transport Association) represents some 290 airlines comprising

82% of global air traffic.

You can follow us at twitter.com/iata for announcements, policy positions, and other

useful industry information.